Due to the continuous changes in the new regulations and policies issued by government agencies on both the state and federal level related to the COVID-19 pandemic, Keevily has made a compilation with information, links, and webinars organized by topics that we consider an essential resource for your company. These official links will be updated daily. We know that, like us, you are receiving hundreds of emails with information related to this situation. Instead of overloading our clients with regular emails, we think it is best to make available these official links, webinars and additional information that you can turn to in search of accurate and up-to-date information.

Your Keevily team remains operating at 100% capacity as we made the necessary accommodations for our employees to work remotely and continue providing the service you deserve. We hope that you find this information a helpful resource. Please do not hesitate to contact us with any questions.

Covid-19 – Important links

Restarting your business

CDC (Centers for Disease Control and Prevention) Reopening Guidance: https://www.cdc.gov/coronavirus/2019-ncov/community/reopen-guidance.html

United States Government Plan: https://www.whitehouse.gov/openingamerica/

Industry Specific Resources: https://www.backtoworksafely.org/

About the disease

Government Response to Coronavirus, COVID-19: https://www.usa.gov/coronavirus

New York State Department of Health has established a website and telephone number that provide the latest, most comprehensive information about the State’s response to the virus.

NYS DOH Coronavirus Hotline: 1-888-364-3065 (fully language accessible)

NYS DOH Coronavirus Website: https://coronavirus.health.ny.gov/home

Other Helpful Resources:

The U.S. Chamber of Commerce: https://www.uschamber.com/coronavirus

Small Business Administration: https://www.sba.gov/

Centers for Disease Control and Prevention https://www.cdc.gov/coronavirus/2019-ncov/travelers/index.html

NYS Department of Labor: https://www.labor.ny.gov/home/

NYS Department of Financial Services: https://www.dfs.ny.gov/

NYS Information

Re-opening NYS: Construction guidelines for Employers and Employees. Mandatory and Recommended Best Practices

ESD CONSTRUCTION STAGING GUIDANCE: https://esd.ny.gov/guidance-executive-order-2026

Return to work plan by Industry (you need to be member of our Safety Groups to access this information:

Guide to Creating a Return to Work Action Plan

Coronavirus Action Plan – General Industries

Coronavirus Action Plan – Retail

Coronavirus Action Plan – Manufacturing

Coronavirus Action Plan – Construction

5-28-2020 New York State Loan Program Open

The application process for New York State’s ‘New York Forward Loan Program’ of $100 million to provide affordable and flexible loans to small businesses that did not receive federal aid is now open. The program will focus on women and minority owned businesses and be limited to businesses with 20 or fewer employees and with gross revenues of less than $3 million. CLICK HERE

NYS Workers Compensation Board

Stakeholder Briefing Now Available: WCB COVID-19 Outbreak Response

The New York State Workers’ Compensation Board has created a briefing to inform stakeholders about the Board’s actions in response to the COVID-19 outbreak. The briefing provides a summary of the actions the Board has taken to date, with links to more detailed information.

Please see NYS Workers’ Compensation Board COVID-19 Outbreak Response.

- NYS Department of Labor: https://www.labor.ny.gov/home/

- NYS Department of Financial Services: https://www.dfs.ny.gov/

- The New York Legislature and Department of Financial Services have been implementing emergency measures in an effort to protect insurance policyholders who have been hit with financial hardship because of the COVID-19 pandemic. A copy of the Executive Order and Regulations can be read on our website by Clicking Here

- New Executive Order Governor Cuomo. This order extends school closures through April 29, and requires any PPE “that is held in inventory by any entity in the state” report it to the state’s Department of Health. https://www.governor.ny.gov/news/no-20214-continuing-temporary-suspension-and-modification-laws-relating-disaster-emergency

- New guidance by the state’s parks system: https://parks.ny.gov/covid19/

- In addition to the recently implemented emergency paid sick leave to provide income protection for employees impacted by the coronavirus, there will be a new permanent paid sick leave mandate that was included in the state’s budget. Provisions in this paid sick leave go into effect 180 days after being signed into law, https://www.governor.ny.gov/news/governor-cuomo-announces-three-way-agreement-legislature-paid-sick-leave-bill-provide-immediate

- Web page to explain how the new federal Pandemic Unemployment Assistance program works with the New York State unemployment process. https://labor.ny.gov/ui/cares-act.shtm

- Paycheck Protection Program local vendor: https://keevilyworkcomp.com/wp-content/uploads/2020/04/Loan-Program-Providers.pdf

- Generic lender participating in the Paycheck Protection Program https://www.sba.gov/paycheckprotection/find

Last updates

– Governor Cuomo Announces Financial and Administrative Relief for All New York State Hospitals. CLICK HERE

– Governor Cuomo and Mayor Mike Bloomberg Launch Nation-Leading COVID-19 Contact Tracing Program to Control Infection Rate. CLICK HERE

– New York Smart Cities Innovation Partnership Program – CLICK HERE

– ESD’s Guidance on Essential Businesses was updated on April 19, at 9:45am. CLICK HEREto find the updated guidance.

Information for Business Owners

General Information

NYS Business FAQ: https://esd.ny.gov/novel-coronavirus-faq-businesses

NYSIF Portal: https://ww3.nysif.com/en/FooterPages/Column1/AboutNYSIF/COVID-19

HR

Paid Family Leave: https://paidfamilyleave.ny.gov/covid19#faqs

Webinars

The Impact of the

Coronavirus on Employers.

We encourage you to watch this video from “The Business Council of New York”. As COVID-19

cases continue to rise in New York State, it is important that employers and

employees understand the impacts of the virus and how the strand affects

individuals, day to day business and the economy.

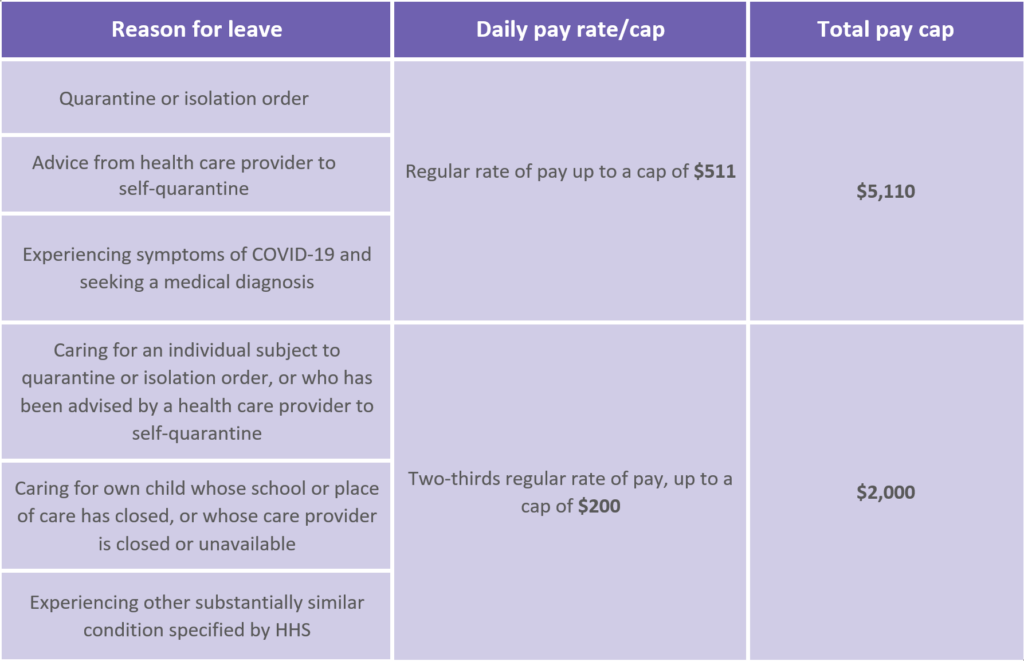

Family First Coronavirus Response Act | What Employers Need to Know

Learn about the most recent developments affecting employers from a human resources perspective and gain insights into what legislation may be coming later this week.

Loans and Financial Resources for Business

SBA Paycheck Protection Program Opening at 10:30am April 27th

Lenders may resume processing Paycheck Protection Program applications beginning at 10:30am today. Additionally, the SBA has recently posted an updated FAQ for lenders and borrowers. CLICK HERE

Federal Relief Bill Approved

On Friday, April 24, President Trump signed a $484 billion federal relief bill into law that will provide an additional $310 billion in funding to the Paycheck Protection Program designed to keep employees on small company payrolls.

CLICK HERE for US Chamber Bill Summary

CLICK HERE for Full Bill Text

Empire State Development Resource Guide to COVID-19 SBA Disaster Loans: https://esd.ny.gov/resource-guide-covid-19-sba-disaster-loans

Coronavirus (COVID-19): Small Business Guidance & Loan Resources: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

The Shared Work Program: https://www.labor.ny.gov/ui/employerinfo/shared-work-program.shtm

Assistance & Guidance for Businesses Impacted Due to Novel Coronavirus: https://www1.nyc.gov/site/sbs/businesses/covid19-business-outreach.page

IRS Tax Relief

IRS: Coronavirus tax relief: https://www.irs.gov/coronavirus

Issues Guidance on Tax Credits for Coronavirus Paid Leave: https://www.irs.gov/newsroom/treasury-irs-and-labor-announce-plan-to-implement-coronavirus-related-paid-leave-for-workers-and-tax-credits-for-small-and-midsize-businesses-to-swiftly-recover-the-cost-of-providing-coronavirus

OSHA

OSHA is providing coronavirus-related guidance to help employers develop policies and procedures that address the following issues:

- Workplace flexibilities;

- Engineering and administrative controls, safe work practices, and personal protective equipment;

- Training workers on the signs, symptoms and risk factors associated with the coronavirus;

- Basic hygiene and housekeeping practices;

- Social distancing practices;

- Identifying and isolating sick workers;

- Return to work after worker illness or exposure; and

- Anti-retaliation practices;

- How to reopen nonessential businesses.

Construction work tasks associated with exposure risk levels: https://www.osha.gov/SLTC/covid-19/construction.html

OSHA has also announced they will be providing training grants for safety and health trainings. The press release can be found HERE

OSHA: Safety & Health topics: https://www.osha.gov/SLTC/covid-19/

OSHA: Guidance on Preparing Workplaces for COVID-19: https://www.osha.gov/Publications/OSHA3990.pdf

Cyber Security & scams warnings.

Guidance on Coronavirus Resources and Warnings about Consumer Scams: https://ag.ny.gov/coronavirus

Cyber Security: https://www.cisa.gov/ If you don’t have Cyber Insurance we can help you with that. Please call 1 (800) 523-5516

Cyber Attacks have increased 800% due the coronavirus outbreak.

There are several steps individuals, businesses, and government agencies can take to prevent a cyber-attack — even with so many remote workers.

- Make sure everyone is using a VPN, or a virtual private network, to do office work from home.

- Require devices to have two-factor authentication, which verifies a person’s identity before logging in.

- Only use Wi-Fi networks that are password protected.

- Companies should maintain a reliable back up for their data on a different network.

- Organizations should make sure their antivirus software is up to date.

- Everyone should think before they click on links and emails.

As always, Keevily remains committed to meeting the needs of you and your employees. We want to help you and your business during the difficult days and weeks ahead.

Thank you.

COVID-19 Disclaimer: Any statements contained herein relating to the impact of COVID-19 and/or the coronavirus on insurance coverage or any insurance policy is not a legal opinion, warranty, or guarantee and should not be relied upon as such. The situation surrounding COVID-19/coronavirus is changing constantly; as a result, any discussions that might take place may not necessarily reflect the latest information regarding recently-enacted, or pending or proposed legislation or guidance that could override, alter or otherwise affect existing insurance coverage. Answers to policy-specific questions will always depend on the terms and conditions of an individual policy and the specific facts relating to a potential claim. As insurance agents/brokers, we do not have the authority to make coverage decisions or render legal advice.