Where:

Syosset, NY

Where:

Syosset, NY

Electronic Reporting Link:

https://www.osha.gov/injuryreporting/index.html

EMPLOYERS WITH 20 OR MORE EMPLOYEES in certain industries employers must also annually file the OSHA 300a through OSHA.gov….

Employers with 20 or more employees per establishment (see definitions below for establishment) and are in OSHA’s list of high-risk industries are required to electronically file their OSHA 300a forms annually. The high-risk industry list includes construction, manufacturing, utilities, department stores, general merchandise stores, general freight trucking, warehouse and storage, waste management services, and other high-risk industries. A complete list of OHSA’s high-risk industries can be found at this link: HIGH-RISK INDUSTRIES

Deadline: 2021 data must be submitted by March 2, 2022

1- When determining the number of employees what type of employees do I include?

All employees at your establishment need to be included, for example, all part-time, seasonal, clerical, principles, etc.

2- I have over 20 employees and I am in construction, do I need to electronically file with OSHA?

Yes, all construction NAICS codes are included in the high-risk industry list. View high-risk industry list (NAICS code 23 Construction includes all codes that start with 23).

3- I have 20 or more employees but I am NOT in construction, do I need to electronically file with OSHA?

Manufacturing, utilities, department stores, general merchandise stores, general freight trucking, warehouse and storage, and waste management services are considered high-risk industries and are required to file electronically. A complete list of OSHA’s high-risk industries can be found on this link: high-risk industry list

4- How do I find my NAICS code?

Use NAICS Keyword Search and enter keywords that describe your operation.

5- If I have less than 20 employees do any of the OSHA recordkeeping rules apply?

Yes, all employers are required to report serious injuries by contacting OSHA within 8 hours of a work-related fatality and within 24 hours of work-related in-patient hospitalization, amputation, or loss of eye (see Severe Injury Reporting ). You may also be required to keep OSHA logs if you have over 10 employees and you are not on the partially exempt list Watch this OSHA 15 minute video to learn more about how to maintain your OSHA logs.

6- If I file electronically do I need to keep OSHA logs?

Yes. Watch this OSHA 15 minute video to learn more.

7- What year data is being electronically filed by 3/2/2022?

You will be filing your 2021 data

8- When will the 2020 data be due?

2021 data will be due no later than 3/2/2022. Be sure to file early!

9- If an employee in my establishment is a contractor’s employee, must I record an injury or illness occurring to that employee?

If the contractor’s employee is under the day-to-day supervision of the contractor, the contractor is responsible for recording the injury or illness. If you supervise the contractor employee’s work on a day-to-day basis, you must record the injury or illness.

10- Must the personnel supply service, temporary help service, employee leasing service, or contractor also record the injuries or illnesses occurring to temporary, leased, or contract employees that I supervise on a day-to-day basis?

No, you and the temporary help service, employee leasing service, personnel supply service, or contractor should coordinate your efforts to make sure that each injury and illness is recorded only once: either on your OSHA 300 Log (if you provide day-to-day supervision) or on the other employer’s OSHA 300 Log (if that company provides day-to-day supervision).

11- If I had no losses do I still need to electronically file?

Yes if you fall into the requirement you must still file “0” losses

Additional OSHA electronically filing questions.

Still need assistance?

Email: Claims@keevily.com or call 1-800-523-5516.

Who falls under this regulation?

Employers with 11 or more employees at any time during the prior calendar year unless industry code is listed on the Partial Exempt List.

When?

Work related injury and illness should be logged on the OSHA 300 within 7 days of knowledge

Deadlines: Feb 1, 2021

You will be required to post only the 2020 Summary 300a form from Feb 1st through April 30th.

Forms Required:

Employers that are required to maintain Injury and Illness records will need three forms:

Instructions:

Watch this 15 min video for a tutorial on completing the Recordkeeping Forms.

Things to Consider:

What type of Injuries or Illnesses are NOT recordable:

Special Consideration:

Travel:

Work from Home:

Injuries and illnesses that occur while an employee is working at home are work-related if they:

Day counts (days away or days restricted)

Incident Rate Calculation – Total number of injuries & illnesses multiplied by 200,000

divided by number of hours worked by all employees = total recordable case rate

For more info please visit OSHA.gov or call your Keevily Team.

Who falls under this regulation?

All Employers

When?

Any time there is a work related death, in-patient hospitalization, amputation or loss of eye.

Deadlines:

You have three options for reporting the event:

Be prepared to supply:

Things to consider:

If there is a in-patient hospitalization, amputation or eye loss you will be required to notify OSHA within the 24 hours, or if there is a fatality, within 8 hours after learning about it. There are some exceptions:

NOTE: However, in each situation you must still record the event on your OSHA injury and illness records, if you are required to keep OSHA injury and illness records.

For Frequently Asked Questions visit OSHA’s website or call your Keevily Team.

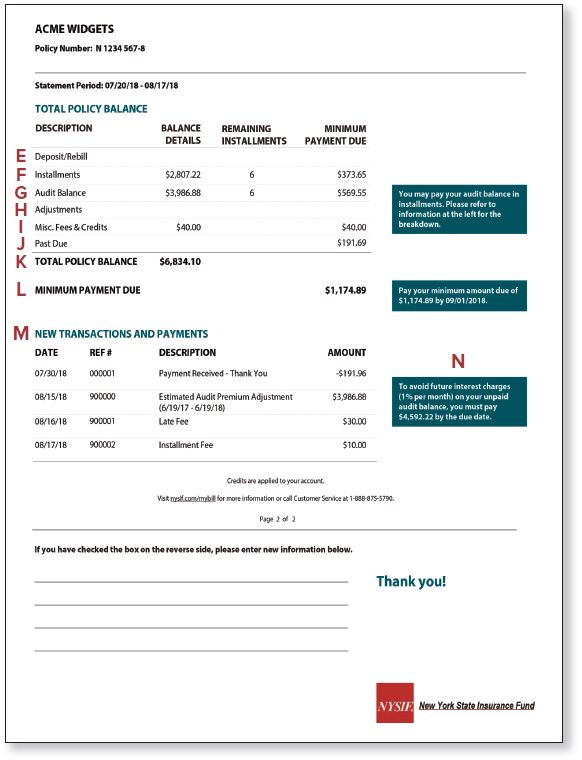

A This box displays a billing summary for the current billing period. Your Total Policy Balance reflects the balance from your last bill and payments, adjustments and fees that occurred during the current billing cycle. Itemized transactions for the current period can be found on the reverse side of your bill under New Transactions and Payments . You must pay the by the date shown to avoid a late fee.

E Deposit/Rebill is the premium deposit required based on initial information in your application. A rebill reflects any premium deposit adjustment based on new information. This amount must be paid in full.

An upstate New York truck driver pleaded guilty this week to perjury after receiving almost $8,000 in workers’ compensation benefits while continuing to work.

Roger Decker, 48, of Lee Center, New York, gave false testimony in a hearing and falsified documents as part of a job application with the state, New York Inspector General Catherine Leahy Scott’s office said.

An investigation found that Decker was injured while working for an Oneida County trucking company in 2004. He began collecting benefits after that and later testified at a Workers’ Compensation Board hearing that he had not worked for more than a decade.

In fact, he worked for at least two trucking companies, Scott’s office reported. In total, Decker received $7,875 in Workers’ Compensation benefits in 2016.

The investigation also found that Decker submitted documents in late 2017 as part of his job application for highway maintenance worker position with the New York State Department of Transportation that falsely indicated he had never been injured while on the job. Decker was terminated from that position upon his arrest in June.

“This defendant’s false testimony and filings were part of a series of fraudulent actions meant solely to enrich himself with financial benefits to which he was not entitled,” Scott said.

Sentencing is set for Oct. 18.

Early in a claim, there may be a question if the injury is work-related. Is the injury a pre-existing condition? Did work actually cause the condition? Is the medical condition directly related to something at work? When these issues arise, adjusters schedule the IME soon after the claim is submitted.

Later in the claim, the adjuster may feel it’s time for the worker to return to modified or regular work. When treatment seems to drag on, an IME may be scheduled. Perhaps the worker had a new, non-work accident. An IME may help sort the work condition from the non-work condition. If the treating doctor awards permanent disability higher than normally expected, an IME may be used to see if the rating is appropriate.

An IME may be scheduled more than once on a claim. The insurance carrier is entitled to examinations at reasonable intervals. If you are concerned about any of these issues and think an IME might help, call us at 1-800-523-5516 to discuss.