Join us for our OSHA 10 Hour Construction Safety Course. But hurry space is limited. Sign up to join us on April 19th and 20th in 6800 Jericho Turnpike Syosset, NY 11791 US.

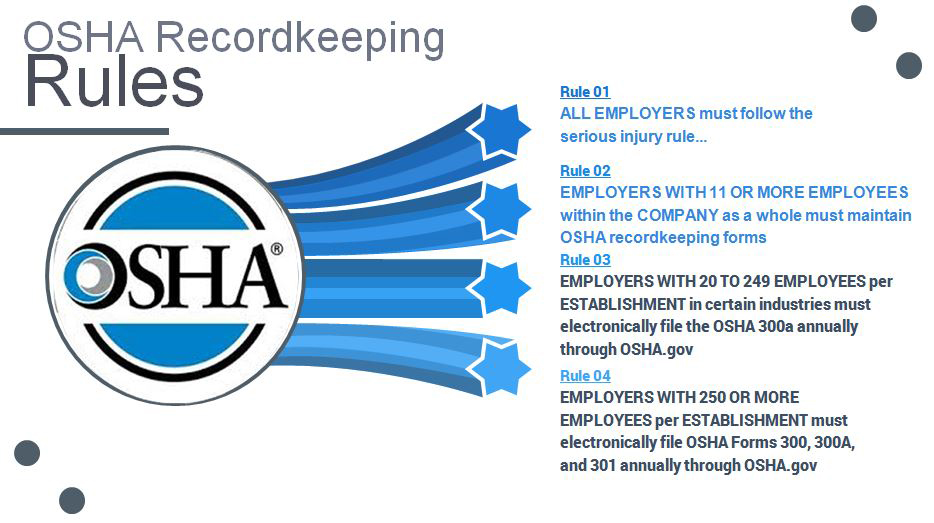

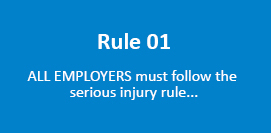

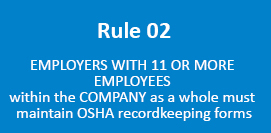

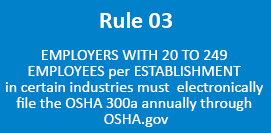

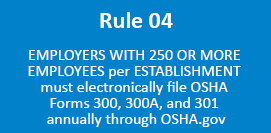

This is a course every business owner, safety manager, supervisor, human resource personnel should take….don’t miss out. A few included topics are the new OSHA’s recordkeeping requirement and various regulations employers are required to follow.

Create a safer work environment, lower your claim history, reduce insurance costs, prevent OSHA citations and fines, learn from a compliance expert. This is a course every business owner, safety manager, supervisor, human resource personnel should take….don’t miss out.

This is a one and a half day training course, attendees must complete both days in order to receive a certification card.

Included in the training are topics such as, Fall Protection, Electrical, Ladders and Stairways, Personal Protective, Cranes, Scaffolding, Hazard Communications and much more.

Future Environment Designs

Instructor: Angelo Garcia III

Angelo Garcia, III is founder and President of Future Environment Designs (FED), one of the nation’s leading indoor air quality, industrial hygiene and safety service companies that is based in Syosset, New York.

When

04/19/2018 8:30AM to 5:00PM

04/20/2018 8:30AM to 12:30 PM

(must attend both dates)

Where

6800 Jericho Turnpike

Syosset, NY 11791

Genevieve Keller

914-412-0563

claims@keevily.com

Register Now!